[最も人気のある!] price action wedge 282119-Price action wedge

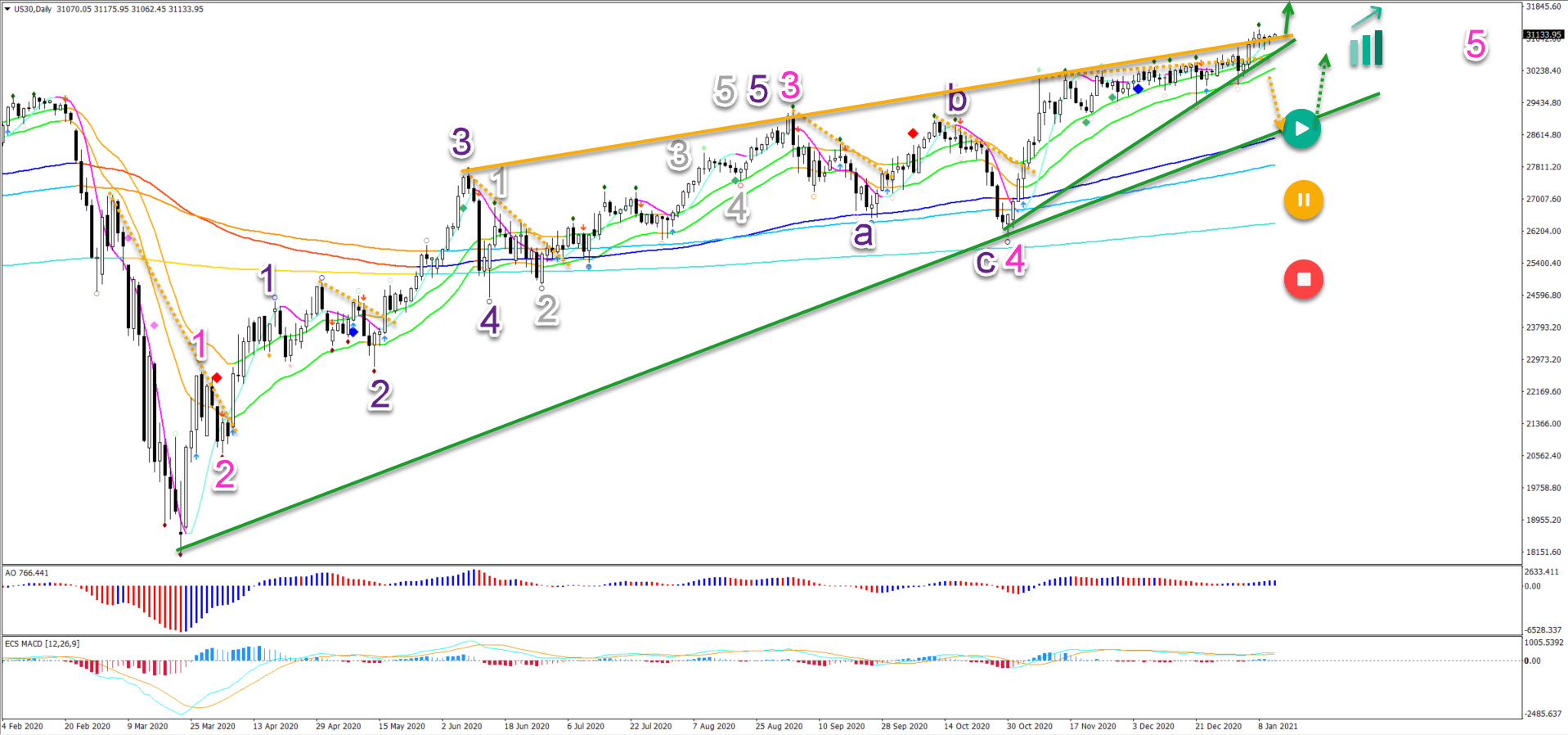

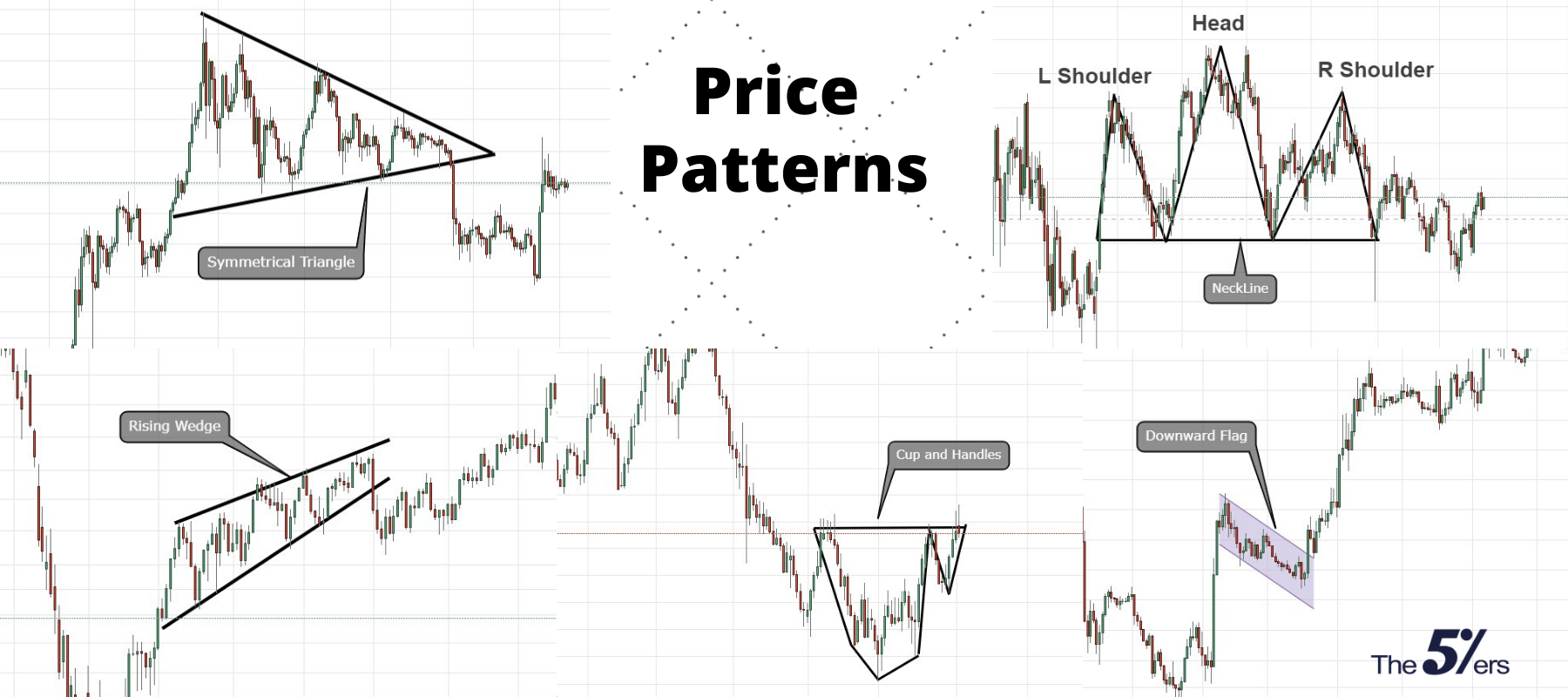

Price Action Indicator Price Patterns That Work!9 Minute Video Goes Into Detailed Explanation 4 Simple but Effective Price Patterns!AS OF NOW PRICE IS MAKING ENDING DIAGONAL/WEDGE KIND OF PATTERN GENERALLY FOUND IN WAVE 5 OF IMPULSE OR WAVE C OF ABC (IN THIS CASE)PRICE HAS ALREADY FALLEN IN INTERMEDIATE DEGREE ABC FLAT CORRECTION TARGET ZONEMINUTE DEGREE WAVE 5 CAN TAKE PRICE TO 300 LEVEL 2 0

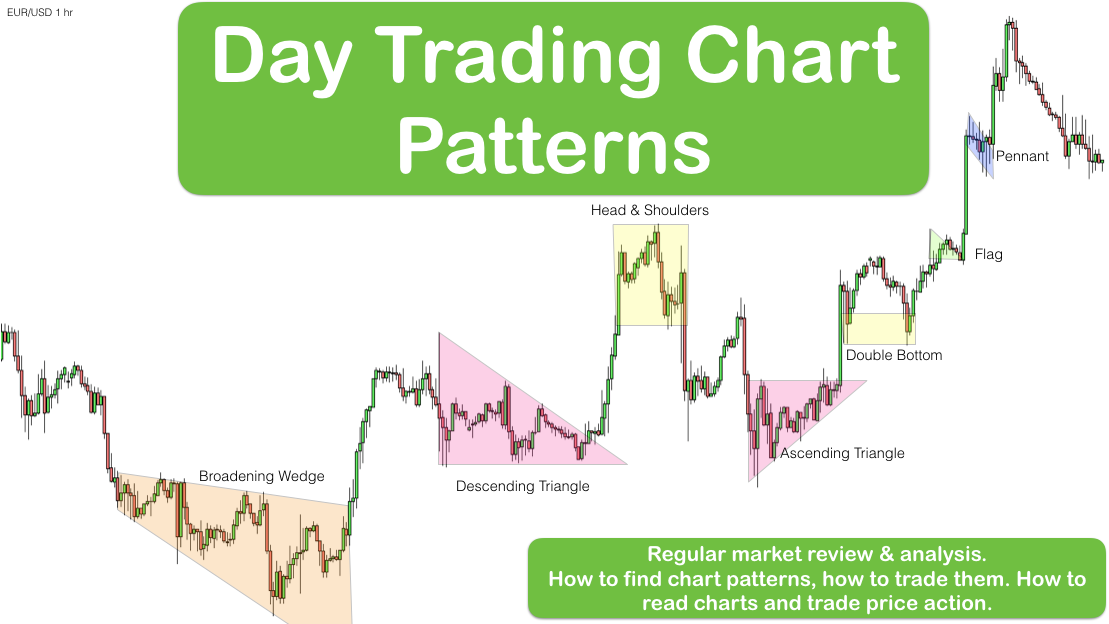

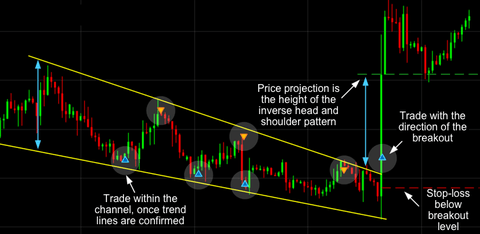

How To Trade Triangle Chart Patterns Like A Pro Forex Training Group

Price action wedge

Price action wedge-#forex #stocks #trading A1 Trading Forex Discord Community Trade alerts, webinars, chatroomsUse code YTVIP for 1tradingcom/vip/FREEIt is formed during an uptrend, you could watch for a

How To Trade Triangle Chart Patterns Like A Pro Forex Training Group

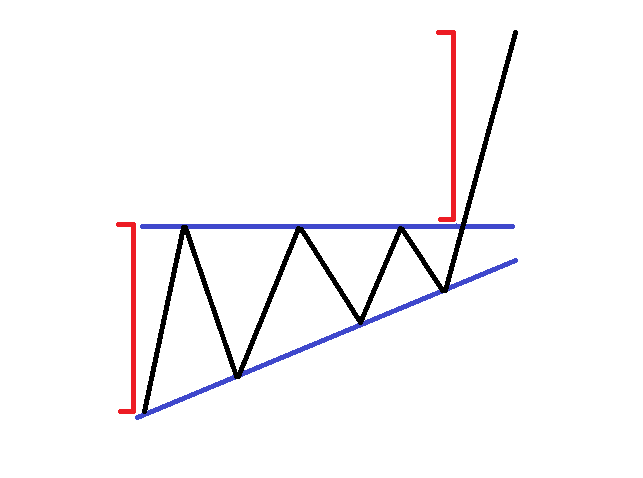

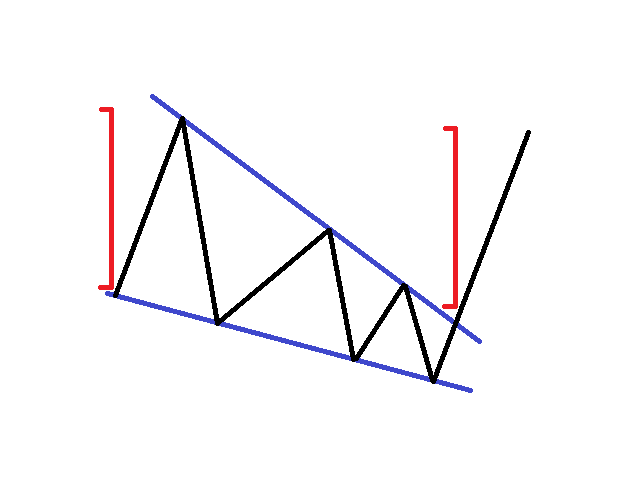

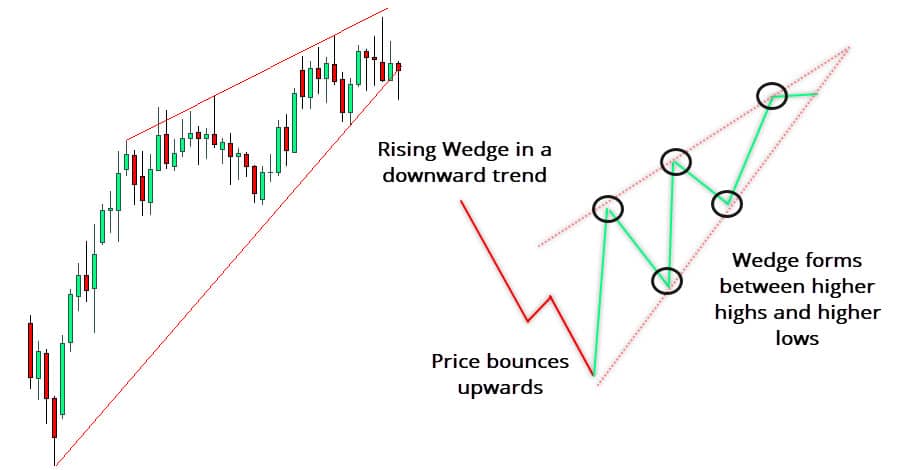

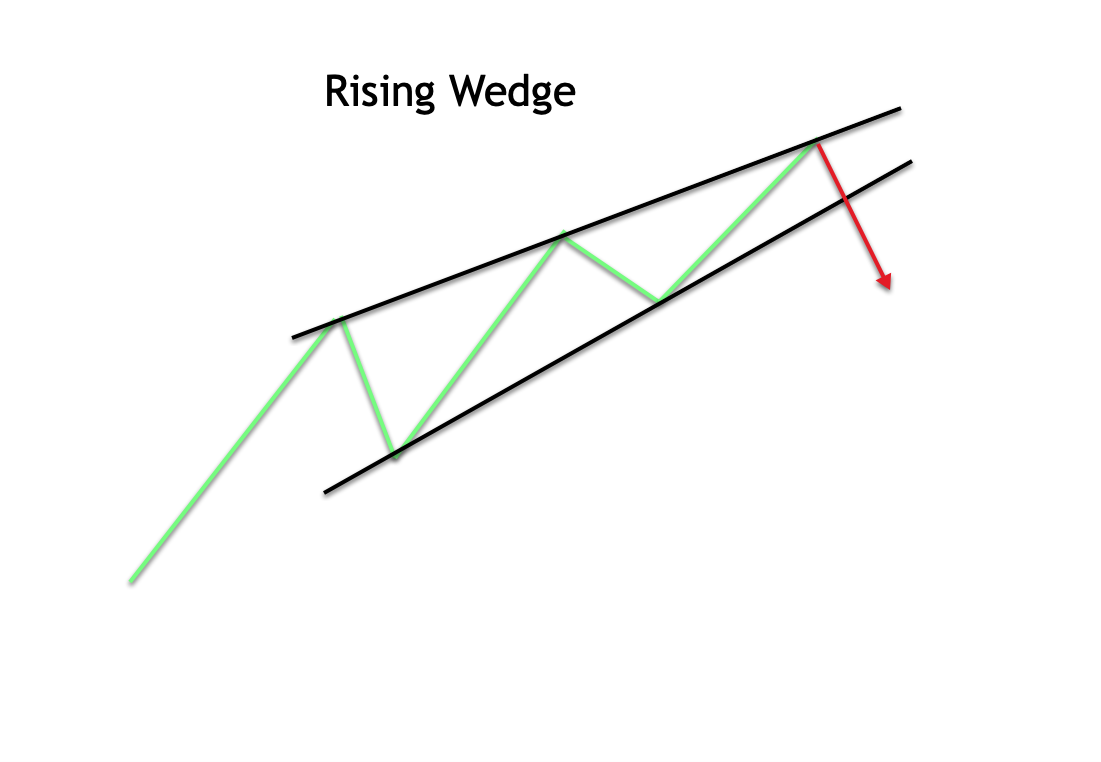

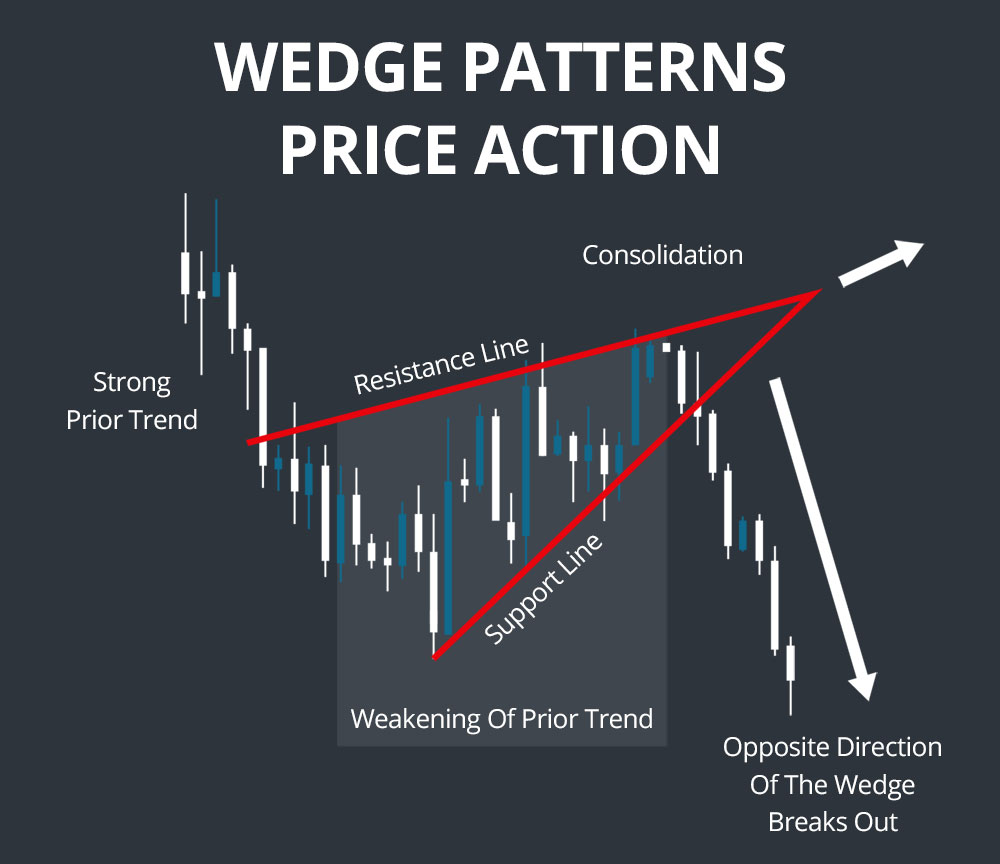

Cleveland tour action Wedge Expert Pick From $00 $3000 74 Results Delivery Condition Hand Brand (1) Loft Flex Gender Shaft Material Model (1) Price See All Filters (2) Save this search Adds to Favorites and notifies you of new items Save $40 2 Cleveland Tour Action REG 5 Lob Wedge 60* RH / Stiff Steel ~34" / NiceJan 23, 21 · The rising wedge is a bearish chart pattern that begins with a wide trading range at the bottom and contracts to a smaller trading range as prices trend up This price action forms an ascending cone shape that trends higher as the verticalA wedge pattern is a corrective price structure that often precedes a new trend leg Wedge patterns are considered consolidation phases wherein there is a contraction within the price movement Volume will also contract during the formation of a wedge pattern

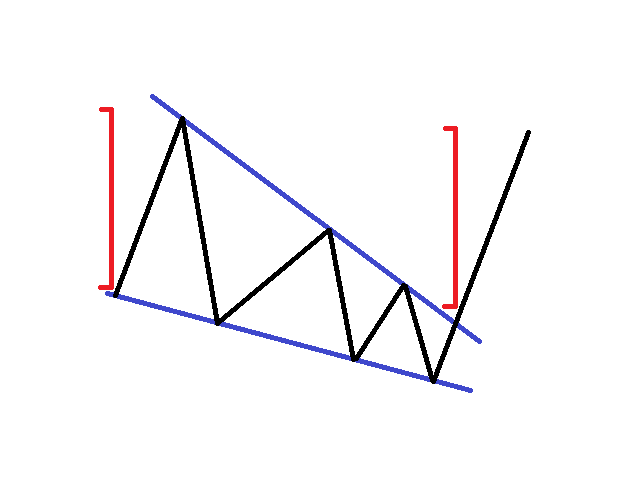

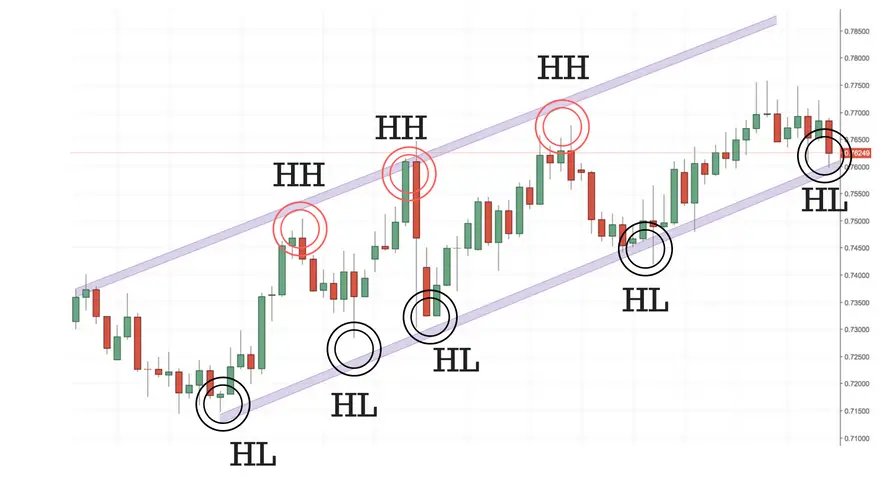

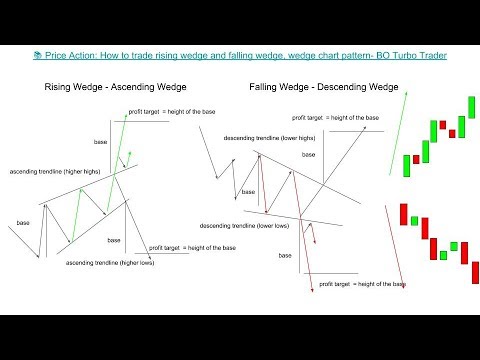

Price action reverse direction from resistance 3 and goes downwards, till finding the second support 4, which must be lower than the first support 2 The pattern is completed when price action reverse direction from 4 and goes upwards till it breaks the wedge's upper border at point 5A price action trader's analysis may start with classical technical analysis, eg Edwards and Magee patterns including trend lines, breakouts, and pullbacks, which are broken down further and supplemented with extra barbybar analysis, sometimes including volume This observed price action gives the trader clues about the current and likely future behaviour of other marketThe Rising And Falling Wedge Pattern The final two price action reversal patterns we're going to look at, are the rising wedge and the falling wedge The rising and falling wedges are two patterns which get their name from the way the market sometimes contracts before the

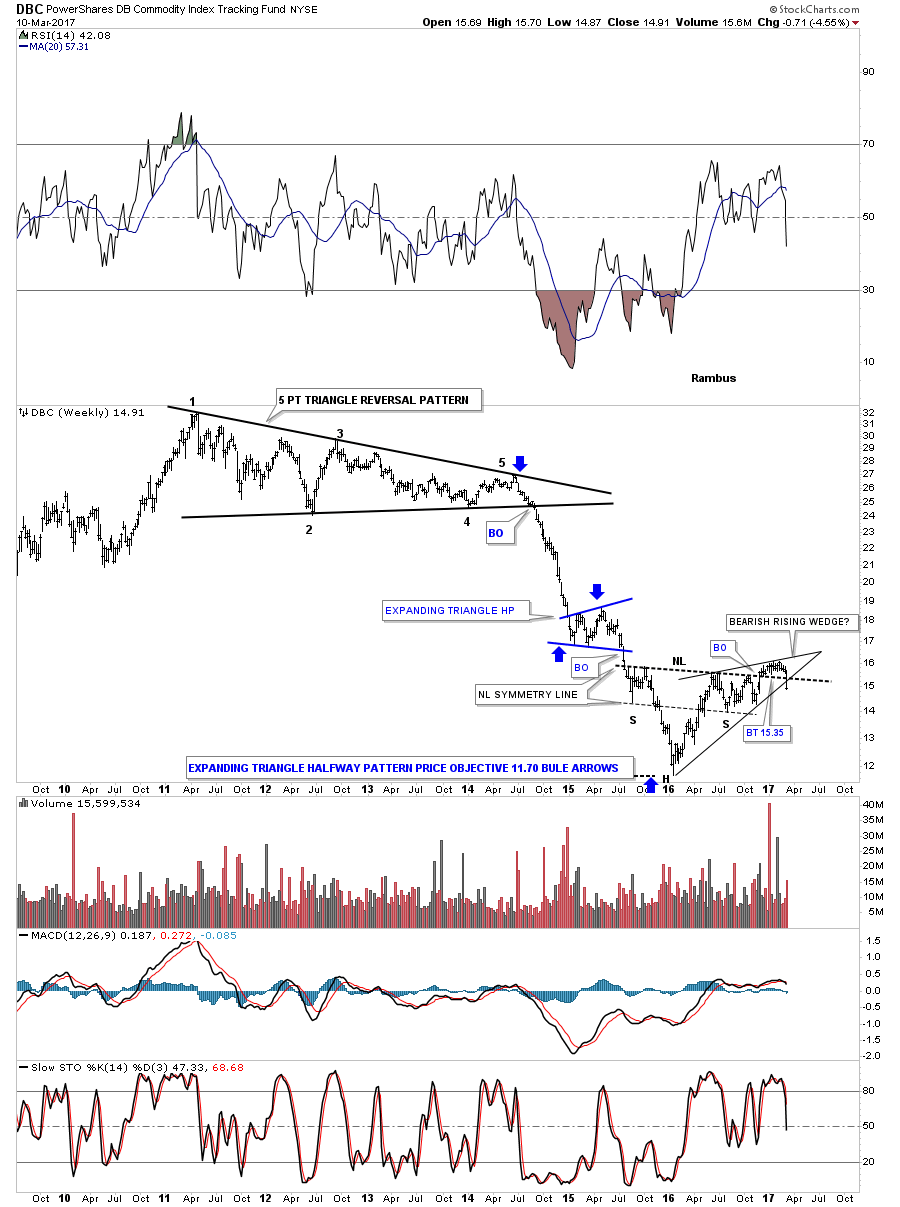

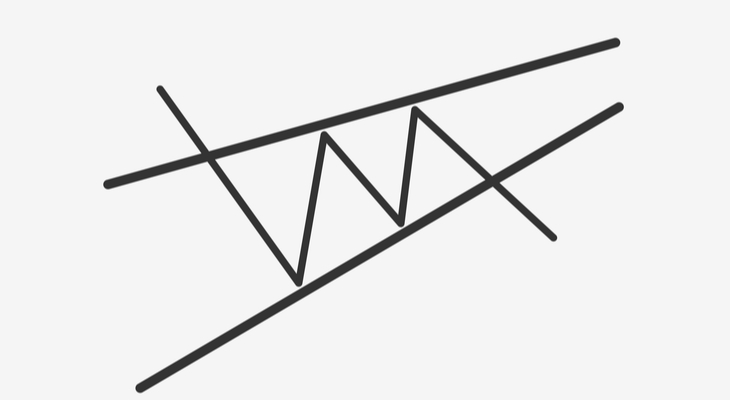

Wedge To Wedge Price Action Mirrors PreCOVID Crash Add a Comment Related Articles Since Its January High, Nio Has Lost 40% Of Value;In a Wedge chart pattern, two trend lines converge It means that the magnitude of price movement within the Wedge pattern is decreasing Wedges signal a pause in the current trend When you encounter this formation, it signals that forex traders are still deciding where to take the pair nextJan 05, 21 · This wedge contained most price action in the pair until the first daily close outside of the formation showed on December 30 th To learn more about symmetrical wedges/triangles,

Wedge Chart Patterns Education Tradingview

/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-01-c68c49b8f38741a6b909ecc71e41f6eb.jpg)

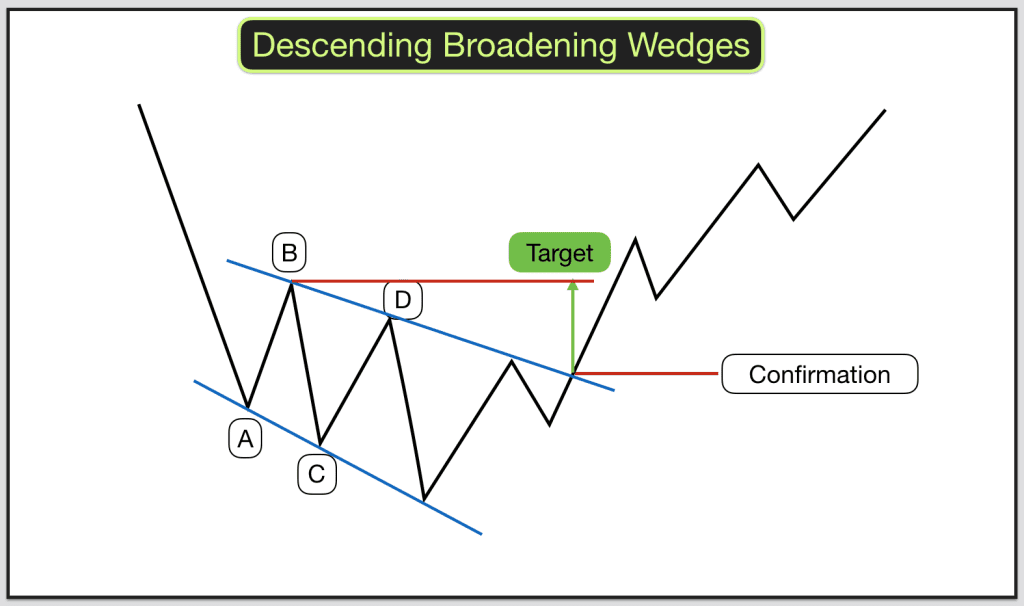

Introduction To Technical Analysis Price Patterns

Feb , · If the price action goes back to the wedge, after a breakout is confirmed, it immediately invalidates the pattern How to trade a Descending or Falling Wedge In contrast, a descending or falling wedge takes place within an uptrend The bulls get exhausted at one point and the price action corrects lower Let's take a look at the EUR/USDMay 25, · FALLING WEDGE FORMATION (PRICE ACTION ON USDJPY) Posted on May 25, June 8, by lucien chi Posted in Trading analysis ged USDJPY On April 8th we predicted an imminent bullish move on the USDJPY pairNov 08, 16 · Broadening Wedge Often recognized as a reversal pattern that occurs after an extended move up or down where the price action "fans out" from the starting point

Simple Wedge Trading Strategy For Big Profits

Wedges Price Pattern

LAZRUS Premium Forged Golf Wedge Set for Men 52 56 60 Degree Golf Wedges Milled Face for More Spin Great Golf Gift 47 out of 5 stars 1,080 $6397 $After seeing incredible gains during early March, LUNA has seen a month of bearish price action During this prolonged bearish period, LUNA has formed a classical bullish wedge pattern, of which it is currently breaking out If volume picks up, this break out could potentially lead to a new ATH in time Keep an eye on LUNA!Mar 14, 21 · There is a possibility that the price will stick to a sideways trend for a long period or even start to decline Summary of rising wedge vs ascending triangle Rising wedge and ascending triangle are quite popular price action trading patterns A rising wedge is a reversal pattern while ascending triangle is a continuation pattern

Rising Falling Wedge Patterns Your Ultimate Guide

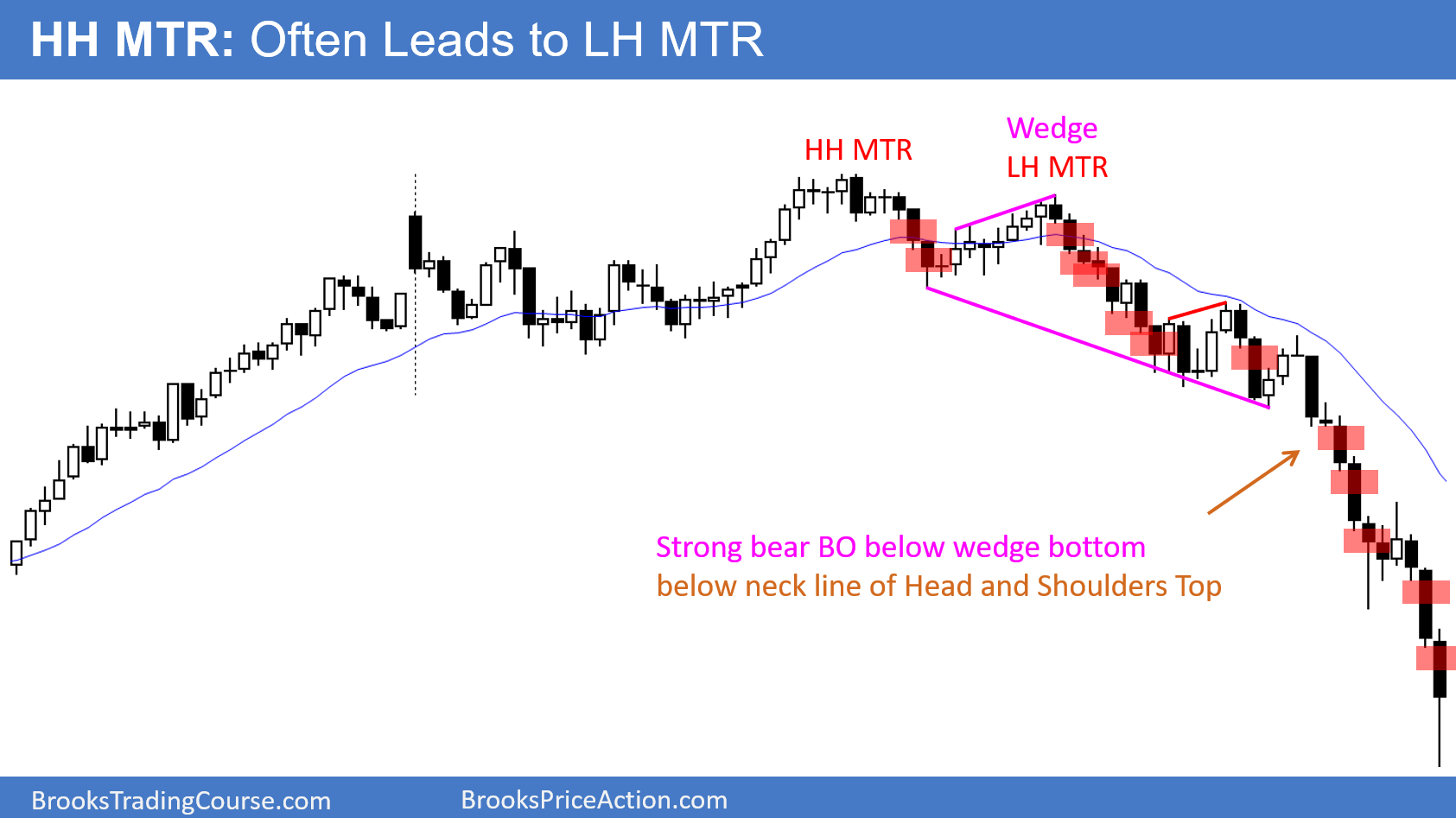

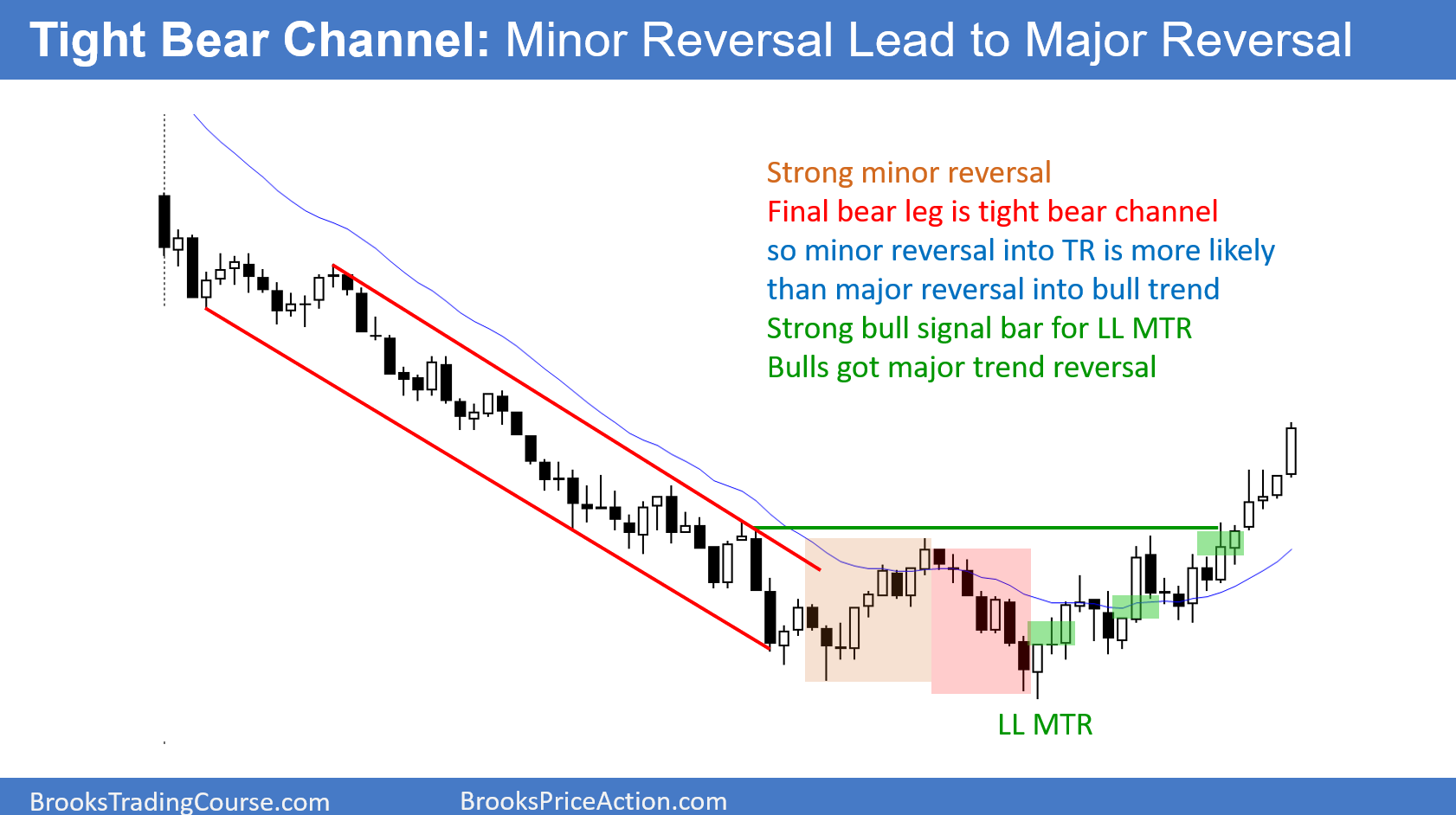

10 Best Price Action Trading Patterns Brooks Trading Course

Price action trading, inevitably, becomes a careful balancing act between the pursuit of greater returns and the avoidance of greater risks While exiting a position too soon can cause price action traders to miss out on easy profits, holding a position for too long can also cause your alreadyearned profits to be eliminated (or cause yourAug 18, · Al Brooks is a full time professional price action day trader who understands what a trader goes through to achieve his goal of making money, and he is a strong advocate for individual traders Al teaches you how to trade online like a professional with his best selling price action trading books, the Brooks Trading Course videos, and through the many articles on this websiteTrade rising wedge pattern like a pro with price action trading – S&P 500 day trading Video ANALYSIS 2/18/21 AM GMT

How To Trade The Wedge Pattern In Forex Forexboat Trading Academy

How To Trade Wedges Broadening Wedges And Broadening Patterns

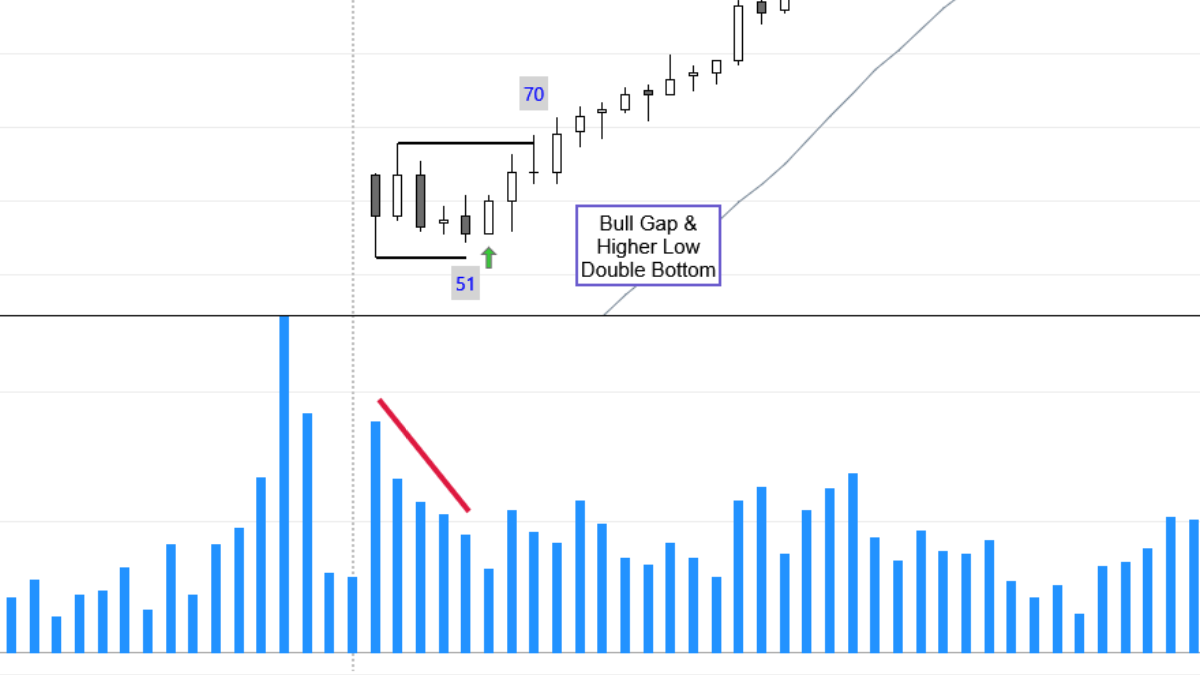

Meanwhile, on the way up the price action creates a rising wedge chart pattern As we discussed, the rising wedge has bearish potential With the the breakout through the lower level of the wedge we notice a minor correction (yellow arrows) At the end of the bullish tendency the price creates another symmetrical triangleAn alternative way to trade Wedges Trading price wedges or price compression requires a plan Here, we explore an idea When price action becomes very contracted near trade locations where supply or demand areas exist, one could establish a trading strategy Either Follow or fade!Aug 01, 19 · The simplest of the price action patterns are the double top and bottom patterns The double top pattern consists of two peaks separated by a trough Both peaks must happen roughly near the same price (less than 5% percent difference) The double top pattern must be preceded by an advance or an uptrend

How To Trade Triangle Chart Patterns Like A Pro Forex Training Group

Weekend Report Beware The Bearish Rising Wedge Rambus Chartology

Yellow = Inside Bar – Breakout Patterns Orange = Outside Bar – Breakout Patterns Green/Red = Pin Bars Aqua/Fuchsia = Shaved Bars ***MANY Features and Customizing OptionsDetailed Overview In VideoMay 24, · Rising wedges are a classic price action pattern which repeats itself quite often in the markets There are different ways to trade this pattern, all of them offering a good to great RR A key skill to acquire when trading any pattern is to stay openminded to the price and what the candles are telling you · With its timeless, versatile design, the Cleveland Golf 5 Tour Action wedge can help any player looking to improve short game performance The tourvalidated 5 shape is made to enhance shots from sand bunkers and deep rough, and also provide confidence and consistency on full swings

How To Trade Wedge Chart Patterns In Forex Babypips Com

Using The Rising Wedge Pattern In Forex Trading

Mar 22, 19 · Cleveland Golf 5 Tour Action Wedge Review Verdict For under a hundred dollars, the Cleveland Golf 5 Tour Action is a good versatile wedge to add to your lineup of clubs It is accurate, dependable, and easy to hit With its clean lines and charcoal finish, it looks as good as it playsFeb 07, 21 · Wedges are useful for interpreting impending price breaks As is the case with flags, wedges indicate instability and problems achieving a consistent support level The convergence of the wedge, backed by declining volume, clues traders in to the potential for a breaking reversal in price actionPrice Action Trading A Wedge Breakout On Crude Oil Futures;

Interpreting Price Action With Chart Patterns Youtube

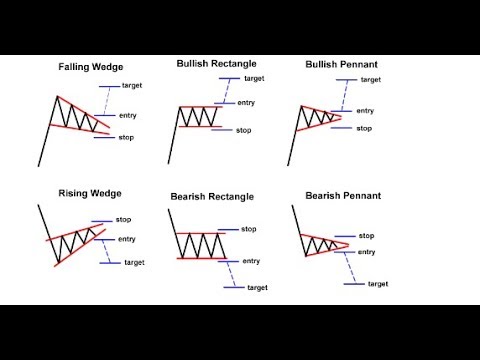

Trading Strategy For Falling And Rising Wedge Pattern

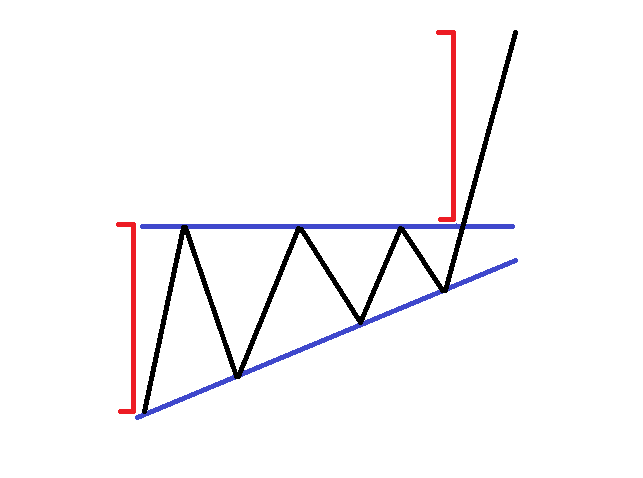

Aug 04, 14 · This is why chart patterns are important because they repeat themselves and it is easy to predict future price action We just need to have patience and wait for the breakout in order to trade them The second kind of basic chart patterns we are going to learn are wedges There are two basic shapes of wedges The first one is the rising wedgeTesting Common Price Action Patterns The statistics on the price action patterns below were accumulated through testing of 10 years of data and over 0,000 patterns In all these cases the price action patterns were only included once they were considered to be complete, which usually means a full break of a support/resistance area or trendlineThe Ascending RightAngled Broadening Wedges (ARABW) have an ascending trendline above the horizontal trendline with price action in between The Descending RightAngled Broadening Wedges (DRABW) have a descending trendline below the horizontal trend line with price action in between With both versions price broadens over time

Gbpusd Price Action Invalidates Ascending Wedge Pattern Orbex Forex Trading Blog

How To Trade Rising And Falling Wedge Patterns In Forex Forex Training Group

SchoolOfTradecom Uploaded by Hugh Martin on May 28, 16 at 1011 am We came in today to see Crude Oil lifting off the lows a bit with an ascending wedge pattern going higher and buyers defending the bear movesJudge the price action momentum with rising wedge pattern and RSI indicator Video EDUCATION 4/27/ AM GMT There are a number of ways to judge the price action momentum116 of 30 results for "cleveland tour action wedge" Price and other details may vary based on size and color Cleveland Tour Action Reg5 LeftHanded Wedge Steel 53°

A List Of The Most Important Price Action Patterns Every Trader Must Know

Rising Falling Wedge Patterns Your Ultimate Guide

Feb 02, 21 · Taking a step back, USD/CAD had built into a shortterm falling wedge pattern coming into last week, right around the time that price action tested a key longterm level from a Fibonacci study"Binary options are not promoted or sold to retail EEA traders If you are not a professional client, please leave this page"Reliable Binary Options BrokerDescending Wedge There are many technical charting patterns that traders can monitor to help them identify price action breakouts These include Ascending Triangles, Descending Triangles, Bull Flags and Bear Flags as just some but, for me, the pattern I find that has the greatest success rate is that of the Descending Wedge The Descending Wedge is a pattern that forms up when price action

Best Price Action Strategy Guide 1 For Chart Reading Mastery

How To Trade Wedges Broadening Wedges And Broadening Patterns

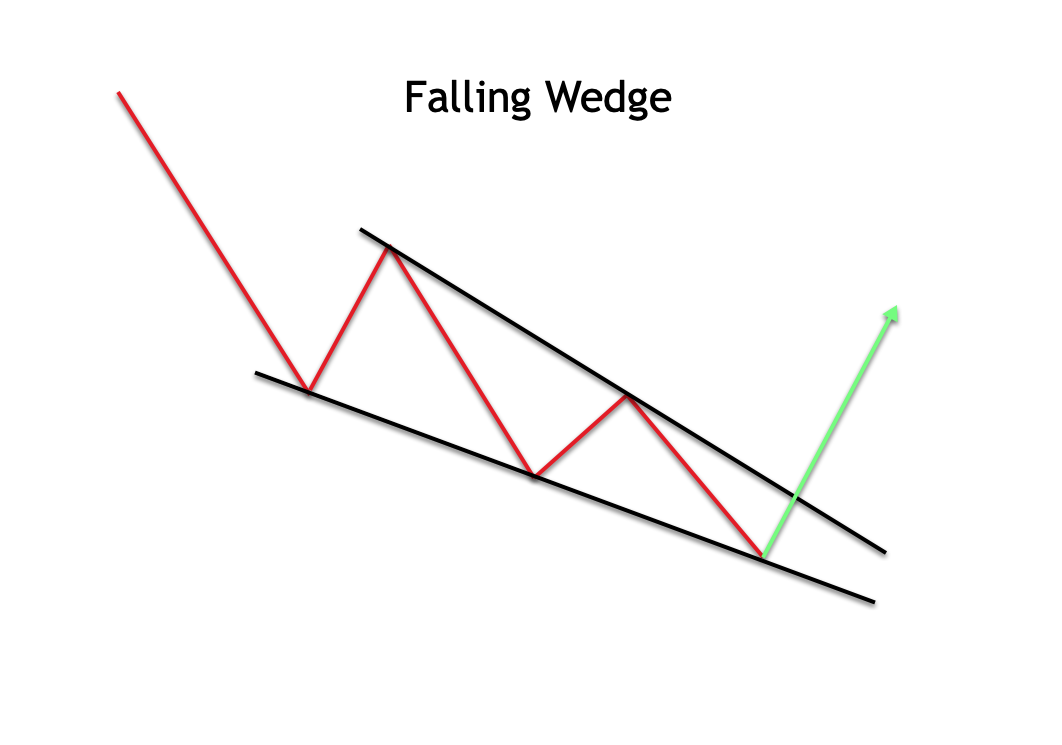

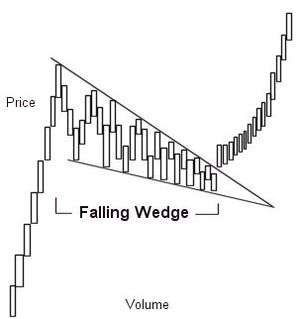

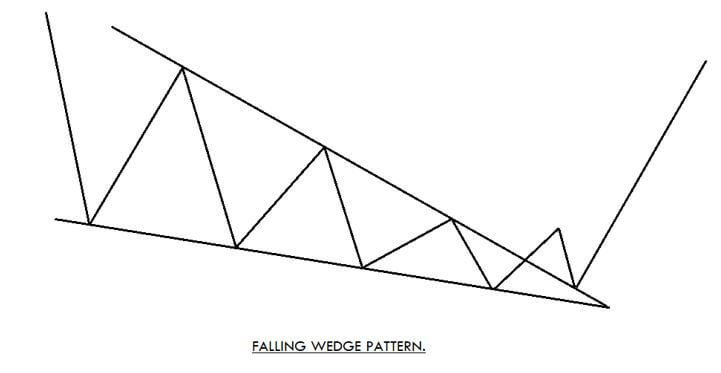

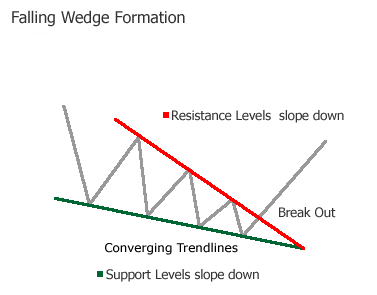

The falling wedge chart pattern is a recognizable price move It is created when a market consolidates between two converging support and resistance lines To create a falling wedge, the support and resistance lines have to both point in a downwards direction The resistance line has to be steeper than the support lineMar 19, 21 · Emini micro wedge top just below 4,000 Big Round Number Bulls want a break above 4,000 and bears want week to close below open for bear bar on weekly chart Al Brooks is a full time professional price action day trader who understands what a trader goes through to achieve his goal of making money, and he is a strong advocate for individualThis is where identifying the market trend and the price action before price moved into the wedge is important This pattern is normally used as a continuation if it is formed during a downtrend If however;

/dotdash_Final_Broadening_Formation_Dec_2020-01-841fcd6b23e14bc4a5b84bba6056d439.jpg)

Broadening Formation Definition

Wedge Chart Patterns Education Tradingview

The price forms highs and lows in the same direction, but the pace at which the two types of extremes are formed differs In our case, a Rising Wedge is a price action zone, bound between upward sloping support and resistance lines One is visualized belowIs The Stock StillThe most common falling wedge formation occurs in a clean uptrend The price action trades higher, however the buyers lose the momentum at one point and the bears take temporary control over the price action The second phase is when the consolidation phase starts, which takes the price action lower

Simple Wedge Trading Strategy For Big Profits

Rising Falling Wedge Patterns Your Ultimate Guide

Apr 07, 21 · The descending wedge is a bullish chart pattern that begins with a wide trading range at the top and contracts to a smaller trading range as prices trend down This price action forms a descending cone shape that trends lower as the vertical highs and vertical lows move together to converge

16 Forex Price Action Patterns Every Trader Should Know

Stock Alphabets Stock Alphabet Stockalphabets Price Action Strategy Best Intraday Strategy New Ipo Intraday Strtegy Mutual Fund Free Demat Account Free Trading Account Ipo

Pin On Forex Daily Setup

Wedge Patterns How Stock Traders Can Find And Trade These Setups

Dji 30 Close To Full Uptrend Continuation Despite Wedge

How To Trade The Wedge Pattern Objectively Action Forex

10 Best Price Action Trading Patterns Brooks Trading Course

Wedges Price Pattern

How To Trade Wedge Chart Patterns In Forex Babypips Com

Rising Wedge Pattern Explained In Price Action Trading S P 500 Day Trading By Ming Jong Tey Datadriveninvestor

Judge The Price Action Momentum With Rising Wedge Pattern And Rsi Indicator Video

Usdjpy Future Direction Hinges On 109 80 Daily Price Action Directions Setup Hinges

Wedge Pattern Wikipedia

How To Trade Rising And Falling Wedge Patterns In Forex Forex Training Group

11 Most Essential Stock Chart Patterns Cmc Markets

Al Brooks Price Action Learn How To Trade A Wedge Top Comparic Com

The 7 Best Price Action Patterns Ranked By Reliability

How To Trade The Rising Wedge Pattern Warrior Trading

Rising Wedge Pattern Explained In Price Action Trading S P 500 Day Trading By Ming Jong Tey Datadriveninvestor

How To Trade Wedge Chart Patterns In Forex Babypips Com

Wedges Price Pattern

A Guide To Trading Bullish And Bearish Pennants Ig Us

The Complete Guide To Technical Analysis Price Patterns The 5 Ers

How To Trade Falling And Rising Wedge Patterns Video

How To Trade Wedge Chart Patterns In Forex Babypips Com

Price Action Basics Price Action Indicators

Price Action Patterns Page 1 Line 17qq Com

10 Chart Patterns For Price Action Trading

Trading The Falling Wedge Pattern

Rising Wedge Pattern Bearish Patterns Thinkmarkets

/figure-1-symmetric-triangle-58222b345f9b581c0b81f6c9.jpg)

Triangle Chart Patterns And Day Trading Strategies

10 Chart Patterns For Price Action Trading

Rising Wedge Pattern Chart Patterns Tradermentality Com

Rising Wedge Pattern Bearish Patterns Thinkmarkets

Forex Hacks Recurring Shapes Patterns Part 2 Of 2 Forex Academy

How To Trade Triangle Chart Patterns Like A Pro Forex Training Group

Pltr Price Action Working Into A Wedge Mucho Tendies Wallstreetbets

Eurusd Falling Wedge Triggers Retest Of 1 1350 Where To Next Daily Price Action Supportive Chart Wedges

How To Trade The Pennant Triangle Wedge And Flag Chart Patterns

Reading Price Action New Trader U

10 Chart Patterns For Price Action Trading

Rising Falling Wedge Patterns Your Ultimate Guide

How To Trade Wedge Falling And Rising Chart Pattern In Forex Tradingspine Com

How To Trade The Rising Wedge Pattern Warrior Trading

Falling Wedge Pattern Hindi Price Action Youtube

Bitcoin Bulls Breaks Ascending Wedge Chart Pattern

Is Price Action Trading The Same As Chart Pattern Trading Price Action Trading

Falling Wedge Pattern Works Option Strategies Insider

How To Trade Wedge Chart Patterns In Forex Babypips Com

Free Download Of The Wedge Pattern Expert By Aharontzadik1 For Metatrader 4 In The Mql5 Code Base 19 07 14

:max_bytes(150000):strip_icc()/dotdash_Final_Tales_From_the_Trenches_The_Rising_Wedge_Breakdown_Dec_2020-01-2693ed6a23b8425ab7c5af77fc1a63d8.jpg)

Tales From The Trenches The Rising Wedge Breakdown

Technical Analysis Series Article 3 Introduction To Pattern Trading By Junior Economist Medium

Wedge Pattern Trade With Falling Rising Wedge Pattern

Price Action Setup Gbpjpy Daily Price Action

Trend Strength And Price Action Analysis Tradingview

Trading The Broadening Wedge Your Start To Profit Guide

Forex Price Action Setups Ahead Of Fomc Ecb Minutes

Al Brooks Wedge Fasrtwo

Price Action Chart Patterns Triangles Wedges More Youtube

The Complete Guide To Technical Analysis Price Patterns The 5 Ers

Trading The Wedge Pattern Like A Professional Technical Trader Forex Academy

Bitcoin Cash Technical Analysis h Usd Price Action Has Formed A Rising Wedge Pattern Subject To A Break Lower Forex Crunch

Falling Wedge Chartschool

How To Trade With Forex Chart Patterns Avatrade

Price Action How To Trade Rising Wedge And Falling Wedge Wedge Chart Pattern Iq Option Youtube

Ripple Technical Analysis Xrp Usd Price Action Remains Dictated By Rising Wedge Pattern Bulls Still Have Chance For Upside Before Another Drop South Forex Crunch

Eur Jpy Price Action Wedges Under 109 95

Chart Patterns To Predict Price Action For Forex Cfd Crypto Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Wedge_May_2020-01-3fc3337b20824354b64193a8e1a949c5.jpg)

Wedge Definition

Falling Wedge Pattern Explained New Trader U

How To Trade A Rising Wedge Classical Pattern Patternswizard

Eurnzd Breaks Wedge Support Targets 1 66 Daily Price Action Trading Charts Supportive Trading Strategies

What Are Rising Wedge Patterns And How To Trade Them

Trading Pattern

How To Trade Wedge Chart Patterns In Forex Babypips Com

Price Action How To Trade Rising Wedge And Falling Wedge Cute766

コメント

コメントを投稿